It’s a feeling that I think every Miles & Points enthusiast will have experienced at some point.

You’ve booted up the credit card application page, eyeing that juicy signup bonus that’ll get you so much closer to your next big trip. You fill in all your details meticulously, taking care not to make any errors that could cause delays in the application process. You pore over the confirmation page one last time. Then, at long last, you click “Submit”.

The screen displays: “Your application will be processed within 60 seconds.” And as the circle on the screen spins round and round, your palms get a little sweaty, knowing that the outcome here could make the difference between flying in a fancy business class seat and squeezing into the back of the plane on your next trip, or perhaps even being able to go on that trip in the first place.

Round and round it spins… until the page refreshes, and you’re approved on the spot. Yay! You may as well start packing your bags and brushing up on your knowledge of business class champagnes right away.

Of course, the other outcome is that your application either gets declined or goes to “pending”, so in this article, allow me to share some advice for when that unfavourable scenario inevitably arises.

In This Post

- Why Might You Get a “Pending” Message?

- Why Might You Get Declined?

- Always Ask for a Reconsideration

- Go Into the Branch

- Apply in Two-Player Mode

- Wait a While and Try Again

- Conclusion

Why Might You Get a “Pending” Message?

There are a variety of reasons why a credit issuer may not immediately make a decision between approving and declining your application.

Sometimes, they simply want to verify with you over the phone that you were indeed the individual who applied, while other times they may require additional information or supporting documents, such as a tax return or a business registration document, in order to be comfortable approving you.

It could even be the case that the issuer’s automated credit approval systems simply need more time to decide than the 60 seconds that they give themselves.

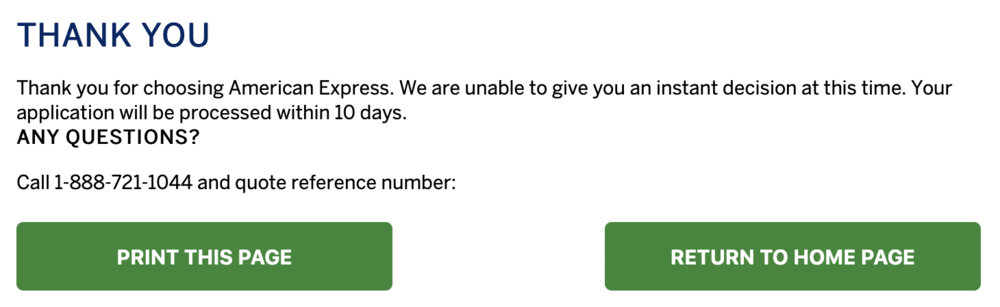

For example, many data points seem to indicate that it’s very rare to get an instant approval when applying for the American Express Business Platinum Card or Business Gold Card; instead, the vast majority of people’s applications seem to go to “pending” with the message that they’ll hear back in 10 business days.

Lo and behold, the card often then shows up in your mailbox within a few days’ time anyway, meaning that you were eventually approved – the system just took its sweet time arriving at that decision.

A pending message on a credit card application will usually be accompanied by a phone number to call in case of any questions. Feel free to call in if you’re in a rush to earn the points, or if you don’t like the anxiety of not knowing the outcome. Otherwise, just sit tight and wait – the credit issuer will call you, if necessary, to confirm whatever details they need to confirm and let you know the status of the application.

Of course, one possible outcome is that you get declined in the end, so let’s talk about that…

Why Might You Get Declined?

Every credit issuer has their own proprietary criteria for deciding whether or not to approve a credit card application, based on the information that’s submitted and the credit file that’s pulled from the bureaus as a result.

These criteria shouldn’t be conflated with your credit score itself, which is more of an indicator of your general credit health that’s calculated by the bureaus for your reference.

Instead, the credit issuers assess the many underlying factors that go into your credit score, such as your payment history, utilization, length of credit history, and number of recent inquiries. They could also take into account other factors, such as how your annual income compares to the amount of revolving credit you have.

Different issuers assess all of these factors differently – for example, MBNA is known to make a bigger deal out of the number of recent inquiries than other issuers. Altogether, it’s hard to say exactly why your credit application might’ve been declined, and the issuers themselves usually aren’t eager to disclose the reason either.

Most often, you’ll receive a letter in the mail saying that your application was declined for “one of the following reasons”, accompanied by a list of all the factors we’ve discussed above, without specifically mentioning which one was the offending item. If you call in to ask, the agents often simply tell you to refer to the letter anyway.

Based on my experience from the various times I’ve been denied for a new credit card (and then pressuring the phone agents to reveal the actual reason of denial), if we assume that you’ve paid all your bills on time and in full and haven’t been running up your credit limits every months, then some of the more common reasons for a denial might be:

-

Your credit history is still relatively new. When my credit file was about two or three years old, I remember having my applications declined about half of the time. Once my credit file became 5+ years old, I began getting approvals of almost all of my applications, with denials only happening very rarely, even though I was continuing to apply for cards (and thus incurring credit inquiries on my file) in the meantime.

-

You have too many recent credit inquiries. When I was first getting started, I mostly conformed to the general rule of thumb of getting two or three new credit cards every three months. Occasionally, I’d get rejected for an application because the issuer thought I had too many inquiries on my file over the past 12 months, which can be a sign of credit-seeking behaviour.

-

Your credit-to-income ratio, or total debt service (TDS) ratio, is too high. This one only happened a couple of times – a credit issuer can sometimes decide that the amount of total credit you currently have available is too high compared to your annual income, and that you might therefore struggle to repay your debts if you were to use up all of your credit limits. The possibility of being declined on a high TDS ratio can be one reason to voluntarily lower your credit limits if you happen to be extended some very generous ones.

If you’re unable to coax the exact reason for a denial out of the phone agent, then you may need to take a closer look at your credit file and apply some guesswork as to what the issuer didn’t like.

Always Ask for a Reconsideration

Either way, though, you should never go down without a fight!

The key idea here is that almost every credit card application can be reviewed by a second set of eyes, and in particular by a human, whom you can bring onside, rather than a computer’s automated algorithms.

This is usually known as a reconsideration, and it’s usually as simple as asking the agent over the phone to submit your application for “a reconsideration” or “another review”. You’ll often have the chance to speak directly with someone in the New Accounts department as they look at your application, allowing you to provide justifications for any of the factors that may have caused the initial denial.

For example, if you know or suspect that you were declined at first because of a large number of recent inquiries, a reconsideration gives you the opportunity to justify why that doesn’t necessarily make you a higher credit risk: “I’ve recently been making an effort to decide on the best credit cards that I should use, so that’s why I’ve been applying for so many new cards to try them out.”

If it was the TDS ratio that tripped you up (i.e., your total available credit was judged to be too high compared to your income), you could make the case that your actual spending hasn’t been nearly as high as your credit limits, and you could point the agent to the actual closing balances on your statements to support this. After all, nuances like this can easily be missed by the computer algorithm at the first pass.

Overall, my experiences with Canadian issuers have been hit-or-miss in terms of whether I actually get to speak to the decision-maker on my application. Sometimes, the application simply gets resubmitted to the New Accounts department for another look, and if this happens, I’ll just get the agent who’s resubmitting it to note down my arguments for why I think I should be approved, and send all of it along.

In contrast, the major US credit issuers seem to more formal procedures in place for reconsiderations on declined applications, and I’ve been successful turning denials into approvals on both the Chase Sapphire Preferred and the Chase Ink Preferred before.

In both cases, my relatively new credit file was a major point of concern, since I had only established a US credit file in 2016. In pleading my case, I mentioned how I had demonstrated a perfect payment history on both of my Amex US personal credit cards at the time, how I also held an Amex US business card that wouldn’t show up on the credit file, and how eager I was to try out Chase’s products as well.

While the reconsideration process on the Chase Sapphire Preferred was relatively straightforward, the Ink Preferred came with a seemingly endless list of additional questions on the nature of my business (like the number of employees, gross revenues and profit, the nature of the business’s revenue sources, etc.), so you’d better be prepared with those answers if you’re seeking a reconsideration on a Chase business card.

There’s no guarantee that a reconsideration will end with a positive outcome (and indeed, on my first two attempts at the Chase Sapphire Preferred, even my reconsiderations were met with a denial, and I only succeeded on the third try), but hey, at least you’ll know that you’ve tried your best.

Go Into the Branch

If you’ve applied for a credit card from one of the Big 5 banks with whom you happen to have an existing banking relationship, then it can be worthwhile to pay an in-person visit to your financial services representative and see if they might be able to help you push the application through.

This has worked for me on at least one occasion: the CIBC Aerogold Visa Card for Business can be quite difficult to obtain online, especially if you’re applying as a sole proprietorship and don’t actually have a small business in the usual sense. When I was in this situation many years ago (and found CIBC’s phone agents to be somewhat obstinate and unhelpful), I eventually found success by dropping into a branch to see if my contact there could help me push it through.

Remember, it’s much easier to convince a human branch representative than a computer algorithm of why you should be approved for a card, and a strong existing banking relationship can grease the wheels even further.

Apply in Two-Player Mode

If you’re applying for cards and earning points as a household in two-player mode or more, then just because one of you gets declined doesn’t mean the other member(s) of the household will get declined as well. If it’s a particularly time-sensitive signup offer, then it can definitely be worth applying again on behalf of your spouse or parent, or even taking the opportunity to convince a new member of the household to join your “team”.

I experienced this with the killer offer on the HSBC World Elite in late 2018, which was worth a cool $550 in your pocket if I remember correctly. My application was met with an instant denial, but when I tried applying under my girlfriend Jessy’s name, she was instantly approved. Suffice to say, I’ve held a bit of a grudge against HSBC ever since.

Wait a While and Try Again

If you’ve exhausted the reconsideration process and are still unable to obtain approval, then all that’s left to do is to let the dust settle a bit, give yourself some time to address the concerns of the credit issuer, and then apply again in a few months’ time.

I remember that when I was first starting out, a declined credit card application would make me feel somewhat distraught, as though all of the travel plans that I had dreamed up using the signup bonus were now suddenly in tatters.

Over time, though, experience has taught me that you’ll get approved for a credit card sooner or later, as long as you continue to build good credit by maintaining an impeccable payment history and a responsible utilization ratio.

And while you’re waiting to reapply for the card you got declined for, you can continue to apply for other cards, although a few tweaks to your strategy might be needed.

For example, if you were told by a credit issuer that pulls from TransUnion (like Amex, RBC, Scotiabank, and MBNA) that you had too many recent inquiries on your credit file, it may be wise to focus on cards from issuers that pull from Equifax (like TD, CIBC, and HSBC) for the next little while, so as to give yourself the best chance of approval when you do eventually apply again.

Conclusion

At the end of the day, declined credit card applications, as frustrating as they may be, are a fact of life in the pursuit of Miles & Points, and everyone will experience the sinking feeling of that spinning 60-second circle landing unfavourably at some point or another.

It’s important to know that a denial isn’t always set in stone, and that they can often be transformed into approvals via the reconsideration process, as long as you’re willing to put your persuasion skills to the test. Otherwise, if you wait for a few months, continue to nurture your credit, and then give it another go, then the chances are pretty good that you’ll get approved eventually.

This recently happened to me. After being an Amex customer of over a decade my application for the Bonvoy card was met with the dreaded “your application is under review and will take 10 business days to process”. I never did get a response so I called and the agent wouldn’t provide a reason but said I could reapply in three months time.. I previously held gold and platinum cards in 2019 and 2023 and currently hold premium cards from other lenders so this was disappointing :/

Just curious if you think I got declined for the TD Aeroplan Visa (that currently has no fee first year and bonus points) because: (1) I have an Equifax alerts on for any new credit applications and/or (2) I had this same card in 2021 but cancelled it in November 2021 (after getting the annual fee waived the first year?} . My credit history etc is excellent so I know it’s not my credit rating.

As for the CIBC business cards, the credit application system is exactly the same as it is in the branch. Getting the Bizline card online was not difficult, but does require a branch visit to give them a copy of your Master Business Licence and to sign one additional form.

This is so frustrating! I have never been approved for the TD Aeroplan card the few times I have applied. I always get worried about reapplying too many times and the ding on my credit score.

I recently tried the Aeroplan Biz Gold (on your reco) through a friend who works at CIBC. She said it was declined due to TDS – even though I have banked with them for years and I have the Aventura with them.

I have recently consolidated a few small limit MBNA cards by calling their call center. I am considering cancelling my Amex Essentials as I have Platinum and don’t really use this card – hopefully to reduce this ratio.

I have high limits on HSBC Premier MC and an RBC Visa which I am not prepared to give up as I cannot guarantee I would get a similar limit with other cards at the moment.

I already have a TD Aeroplan infinite visa through my TD all-inclusive banking plan. Now, how do i get another card with this free 15000 aeroplan miles (after first purchase ) ??? thank you

The card is currently offering First Year Free so you’d get that offer if you were to apply for a new card now.

I have a question. I have blocks with Equifax and Transunion die to identity theft.

Any suggestion how to expedite my applications since I’ll not be approved instantly anymore.

I went to CIBC in person and a manual review was still required. Outcome unknown at this point.

Credit file blocks are known to make the process more cumbersome. Unfortunately I’m not aware of any ways around this, since they’re done for your own protection after all, but maybe someone who has experience with the matter can chime in.

Hello! Thanks for the good work, its always interesting. About TD. I’m having a lot of problems getting credit for TD. Anyone know what’s the problem? What is the trick? Last 12 credit cards, all approved but TD. My mother tried yesterday and application could not be processed. Are we just unlucky?

My spouse and I applied in the last 2 weeks. We got approved but in talking with them their systems are not working well. An agent told me that the automatic system is applying the wrong address to the request and assigning branches in other provinces as the closest branch. I suggest you call them for reconsideration and express empathy for their recent system glitches.

Hi Ricky,

How long would you recommend waiting after a denial? It’s Amex (non-business) I’m most interested in at the moment. Usually, I get accepted by them (have 3 of their cards currently) but occasionally I get refused.

Thanks Ricky for your article.

I applied for Biz Plat in May of last year, and then self-referred to Biz Gold in July after hitting the minimum spending requirements. Was declined because "they had the original application approved." I self-referred to Biz Gold in November and they denied me for the same reason. The rep told me to wait 6 months until trying again. Should I cancel the Biz Plat and apply for the Biz Plat again in June?

Excellent article Ricky. Can you please share your experience with HSBC denial? Did you contact them for a reconsideration?

I did – they mentioned it was due to a high number of recent inquiries, and the reconsideration unfortunately resulted in the same outcome. But I can rest easy knowing that I did all I could.

Hi Ricky,

Thanks for your writeup. How long do you wait after a decline to try again at the same bank/same product?

I was recently declined for the Avion 25k FYF promo but I know what triggered the decline. Now that that has been fixed, can I try again within 3 months time?

Thanks!

I usually wait 3 months, bearing in mind the strategy of "going easy" on the credit bureau that the issuer pulls from in the meantime.

So true. Just got turned down by MBNA on the basis of too many credit enquiries but got a third Amex Plat card the same week;)

Did you call their credit department and ask to split the credit limit on an existing MBNA card (if you have one)?