One of the first cardinal rules that you learn as a newcomer to Miles & Points is to always pay off your credit card bills in full and on time. While that’s very much the ideal scenario to aim for, it’s also quite possible that you might miss a deadline or two over the years, so it’s worth knowing what exactly happens on the off-chance that you fail to meet the payment due date.

On last week’s Virtual Miles & Pints livestream, a viewer asked what are the best ways to stay on top of payment deadlines – especially once you start managing dozens of cards across multiple individuals in multiple geographies – so that you don’t miss a payment and “ruin your credit”.

This might come as a surprise to some readers, but I have in fact missed my credit card payment deadlines in the past, and every now and then still find myself red-faced as a result of logging into one of my online accounts and seeing the message “Your payment is past due”.

Thankfully, even though you should do your best to make payments on time and in full, it’s really not the end of the world if you occasionally miss the deadline by a few days. In this post, let’s clear up exactly what happens in that scenario, and I’ll also talk about some of the strategies you can use to stay on top of your payments (and invite you guys to share some of your strategies as well, because clearly I could use some help here).

What Happens If You Make a Late Payment?

Most credit cards provide a grace period of around 21 days after the statement closes for you to make your monthly payment without incurring any interest. If it’s a regular credit card, then you’ll also need to make a certain minimum payment by this 21-day period in order to avoid late fees, whereas if it’s an American Express charge card, then you’ll need to pay off the balance in full.

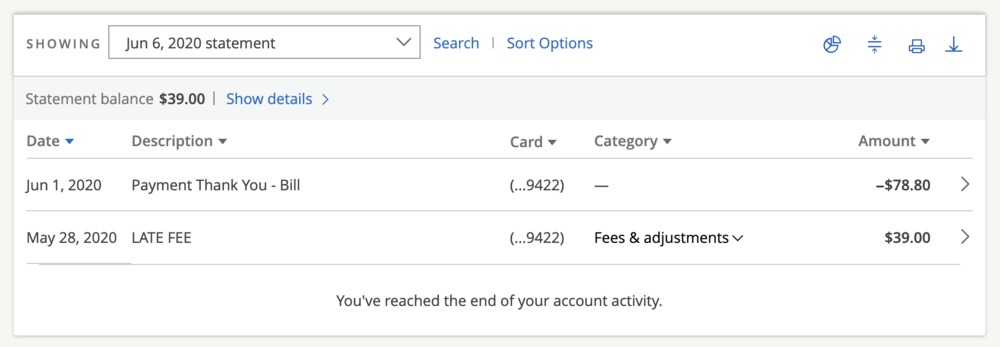

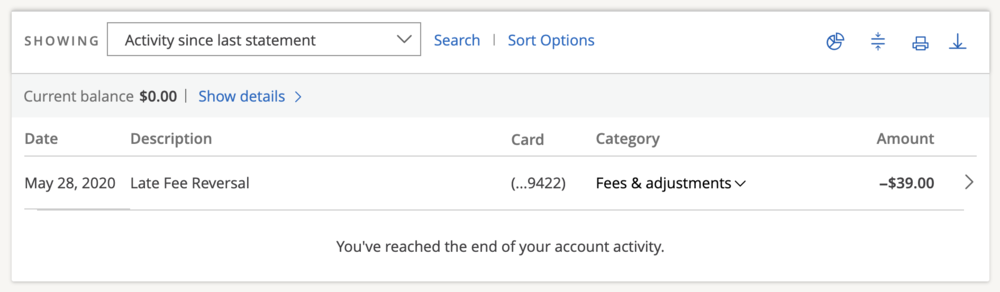

If this initial deadline is missed, the only immediate impact is that you end up having some interest charges and/or late fees added to your next bill as a penalty for late payment.

The late fee is usually a flat fee that varies by bank in the range of $20–40, whereas the interest charge is calculated based on the number of days between your payment due date and the day you actually made your payment.

It’s worth noting that the interest is calculated based on the credit card’s annual percentage rate (which is usually 19–22%), scaled to the number of days you were late, and applied to the full statement balance, not just the minimum payment amount. Therefore, if you missed a payment on a particularly large monthly statement, you might find yourself hit with some surprisingly hefty interest charges.

It’s important to differentiate these financial penalties from the actual credit impact of making a late payment. It’s widely believed that making a single late payment can harm your credit badly – indeed, I myself was quite panicked the first time I realized that I had missed a payment deadline by a day or two, especially after recalling that the “payment history” criterion accounts for 35% of your overall credit health, and

However, credit card issuers only report payments to the credit bureaus as “delinquent” once your statement is 30 days past due, 60 days past due, and 90 days past due.

Each of these thresholds has increasingly severe impacts on your credit report, doing real damage to the 35% of your credit score made up of your payment history. Once you have a 30-day-late remark on your credit file, it remains on file for many years to come, tainting what may otherwise be a perfect payment history.

But the corollary to this is that if your payment was only one or two days late, or even a week late, then you’ll only be faced financial penalties in the form of a few extra charges on your next statement. As long as you make even the minimum payment on the credit card by the 30-day mark, the issuer will continue to report the account as “current” and the credit bureaus will be none the wiser.

What about those pesky late fees and interest, though? It sucks to have to pay an extra $50 on your statement because of an honest mistake here or there, and credit card issuers are usually sympathetic to that.

If you give them a call, they’re usually more than willing to waive the late fees and interest charges if it’s your first or second offence. As usual, play to the phone agent’s emotions by saying how you made an honest mistake in forgetting the bill because it’s been a stressful week, or something to that effect.

And if you can’t be bothered to pick up the phone? Well, good news: the banks are increasingly less bothered to waste their breath on this stuff, either.

I’ve recently seen many banks handling late payment issues over Live Chat or the automated phone line: Amex Live Chat (in Canada and the US) will usually be happy to waive your late fees and interest, whereas when I called both Chase and Citi in recent months, the automated phone line instantly credited back all of my additional charges as soon as I said that I was calling about “late fees”.

Why Might a Late Payment Occur?

Accidentally missing a deadline here or there isn’t necessarily the end of the world. Therefore, the adage of “always pay your balance in full and on time” is more of a general caution against the practice of carrying a credit card balance on an ongoing basis (because doing so will quickly erode the rewards that you’ve earned and is poor financial practice in general).

To that end, everyone has the best intentions of making all their payments on time, but over the years, I’ve had my fair share of missed deadlines for a variety of reasons, and I think it’s worth going over the reasons why someone might inadvertently miss their credit card payments.

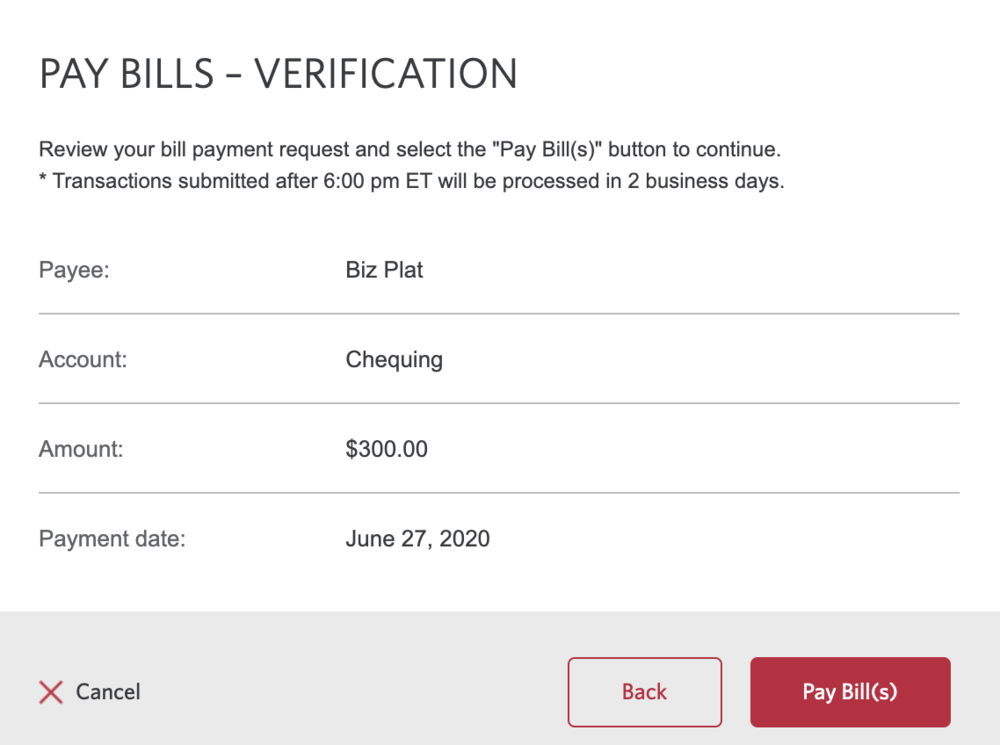

The most common reason that I’ve seen boils down to the difference between making a credit card payment from your online credit card account versus from your bank account.

When you enter your bank details on your credit card account to make a payment, the credit card issuer “pulls” the money from your bank and instantly records the payment.

Meanwhile, when you enter your credit card details using the bill-pay feature on your bank account, the bank “sends” the money to the credit card – a process that can take several business days.

I’ve always been in the latter habit: entering all my credit cards as billers using my bank account’s bill-pay feature and making payments from there, instead of entering my bank details on every credit card (not to mention that many Canadian Big 5 banks’ credit cards don’t even let you pay your bills that way).

Therefore, even if I make a payment from my bank account a few days before the payment is due, it might not actually arrive until a day or two after the deadline, in which case I would be hit with a late fee and interest charges. Throw in a statutory holiday somewhere along the way, and this outcome gets even more likely.

Of course, the solution here is to make your payment well before the actual due date. Indeed, I admit that I really shouldn’t be getting tripped up by the interbank payment delay as much as I have in the past, and it speaks to a larger reason why one might occasionally miss their payment deadline: sheer complacency.

With how busy our lives are these days, even if you have the best intentions, one credit card statement out of dozens upon dozens (especially if it’s not a card that you use regularly, but have used on a few occasions) can easily slip through the cracks.

How to Avoid Late Payments in the First Place

So, what’s the best way to stay on top of all the moving deadlines across your credit card portfolio?

If you have mindset of “better safe than sorry”, then a common practice is to pay off the entire statement balance instantly as soon as the statement posts. However, if you’re a stickler for optimization, then you want to keep your money on hand for as long as possible during that 21-day grace period before handing it over to the bank to pay off your bill.

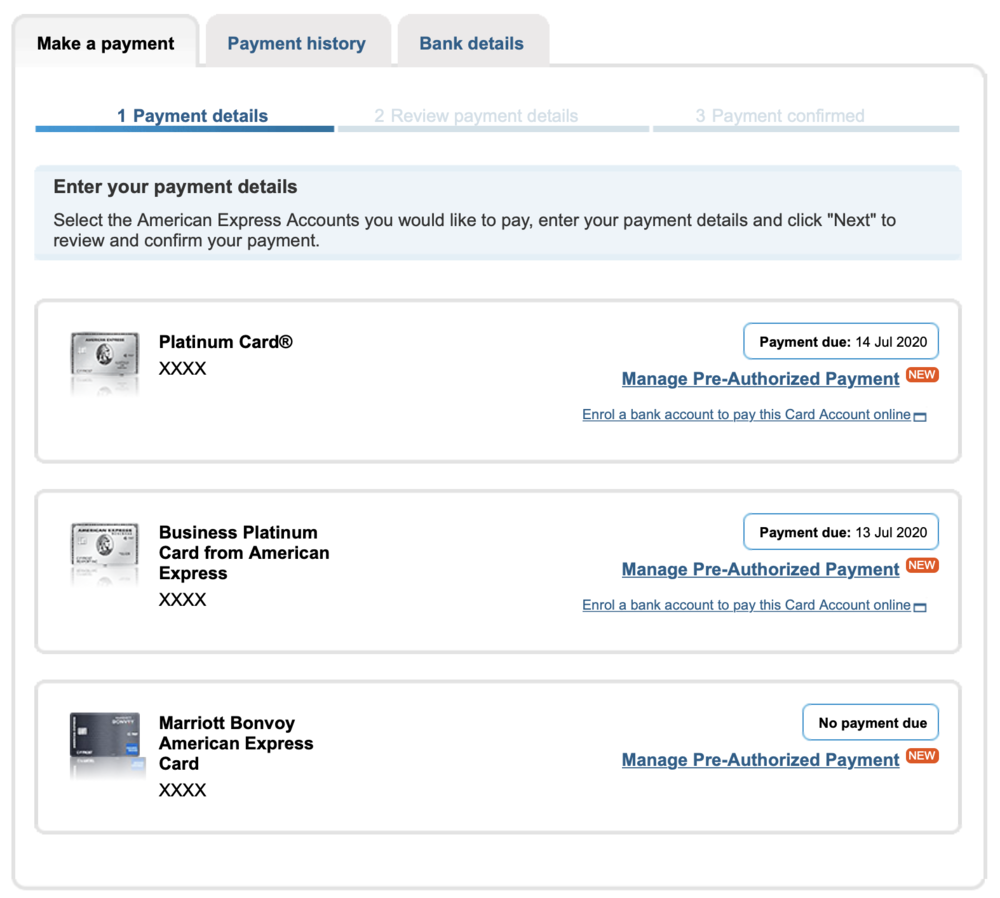

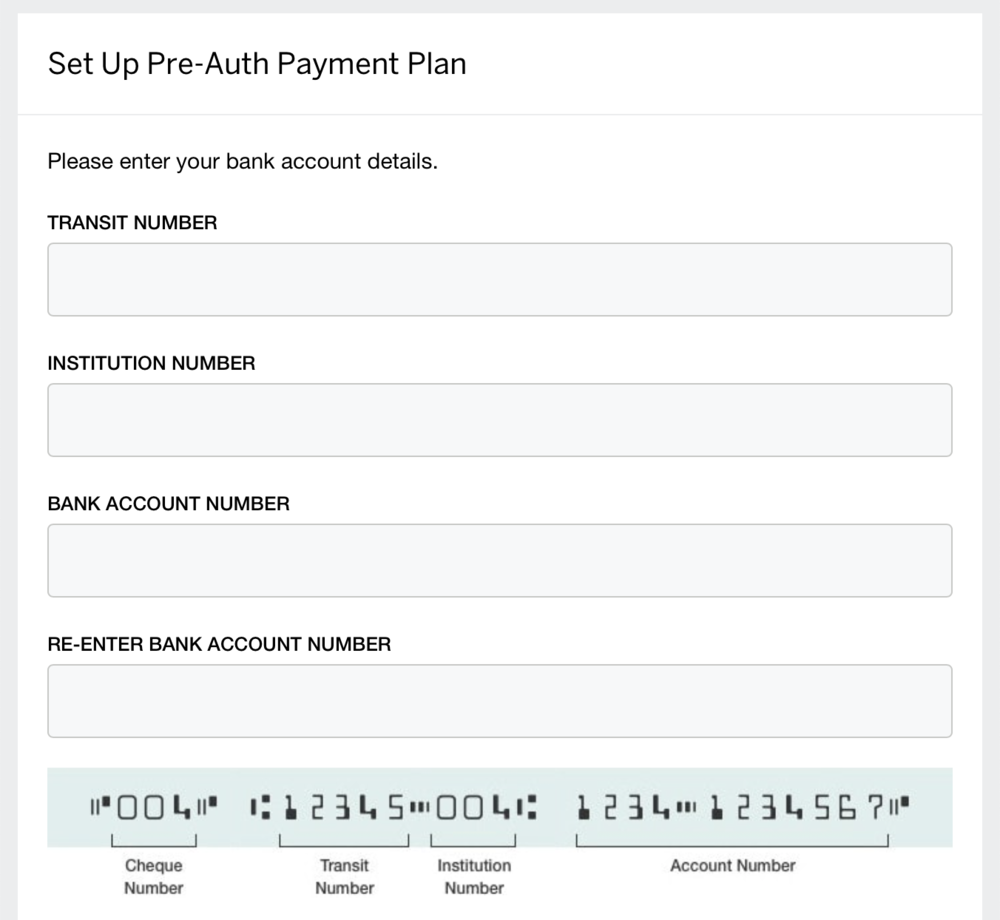

One of the most common ways that the issuers themselves tend to encourage is to sign up for pre-authorized payments from your bank account. Once the initial agreement is set up, the credit card issuer automatically “pulls” the funds from your chosen bank a certain number of days before payment is due, thus ensuring that you never have any missed payments to worry about.

While some people do prefer to simplify their lives through pre-authorized payments, I’m personally not a huge fan.

I prefer to always be aware of the exact amount and timing of funds leaving my chequing account at any given moment, and on top of that, I find that the credit cards can easily overcharge your bank account and deduct more funds than necessary if, say, your last statement balance was later offset by a large refund or a generous statement credit promotion or two.

Therefore, I tend to rely on a slightly makeshift system to stay on top of everything: I sign up for email notifications when a payment is due in a week’s time (which many banks, but not all, offer), and I also make it a habit to log in to all my credit card accounts and check-in on everything about once a week.

By and large, this gets the job done. But it isn’t perfect, and sometimes I still find myself grovelling over Live Chat to get a late fee waived, which leaves me wondering: how does everyone else prefer to do it, and maybe there’s a better way out there?

Conclusion

I’d love to hear about your chosen methods for staying on top of your credit card payments. Do you make your payment as soon as the statement hits? Do you sign up for pre-authorized debits for the peace of mind? Or do you simply log in and check-up on all your credit cards on a regular basis like I do? I’m curious if see are any techniques I haven’t considered yet that, like many things in our hobby, do a good job of balancing convenience and optimization.

No matter how you prefer to do things, remember that it’s not the end of the world if you do miss a payment by a few days every now and then, with no real credit impact as long as you avoid a 30-day delinquency and only a handful of pesky fees that can easily be recovered.

I’m using a Macbook Pro so I just have the ‘stickies’ (yellow sticky note) app as an overlay on the desktop off to the side with all my cards’ details on there plus when applicable I set up autopay, especially with amex, and my main visa/mc

When ever I get a new Credit card I phone the credit card and set up auto pay out of my TD bank chequing account.

One phone call per card and problem solved.

I have used TD autopay to pay off CIBC, Royal Bank, AMEX credit cards no problem.

Never a late fee.

To lazy to do it an yother say.

I have an excel with the list of all my credit card and some other payment (tax, etc) with their statement date (list order by those date ) and a few column for amount to pay, date limit, date of payment. I print it at the beginning of month and I fill those few column when necessary base on those date limit. This print out is allays on my desk so I know when I have to do some payment. And I have those reminder email from my credits cards. I don’t like the pre-authorized thing, I prefer to ‘stay’ in control what is going out of my bank account. And some time, when the amount is not to high, I can pay ‘in advance’ to help make my credit score to go higher (after a few hit on my credit score).

That’s dedication! I do agree with the mindset of "staying in control" of what’s leaving my bank account.

I found with CIBC Visa – to get auto pay of the Visa from a CIBC chequing account working – I had to have them snail mail me an auto-debit form which I then had to fill in, scan and ‘fax’ it back to them (using faxzero.com). Meanwhile – for my US credit cards I just fill in a web based form on their site to set up auto pay from my RBC Bank USA account.

Yep, I’ve found Canadian Big 5 banks to be particularly bothersome in terms of setting up pre-authorized debits from other banks.

I just use mint.com to track all my card balances and pay them all off about once every week or two, so it doesn’t even matter when each card’s statement date it. Have never missed a payment.

For a busy life, I still prefer the auto-debit from my cheque account every month is the best way for me not to miss any payments.

Better safe than sorry, I suppose. I do understand that perspective.

Pay off any balances in full on the 15th and 30th of every month. Makes things simple, and the habit has stuck.

I have a weekly reminder on my phone to pay my bills every Sunday.

I log into all my bank accounts, check the balances, then pay them all from my chequing account. Takes 2 minutes

That’s pretty much what I do (Sundays as well), without the reminders. Maybe it’s time to add them.

A tip: For those cards you use every month or two, set up an automatic payment of, say, $30 each month for 3 days after the statement cut off date. That way, even if you miss the payment that month, you have paid the minimum payment and will not incur the late fee or damage to your credit. You may be charged some interest, but not much. Then pay the balance closer to the payment due date.

I used YNAB. It’s a godsend for more than just never missing CC payments.

I’ve heard good things about them too.

I’ve added monthly recurring calendar alerts to remind me to pay my bill 1 week out from due date. That, coupled with a customized monthly paper calendar that I print out (like a cave man) and update each month with all my expenses and due dates detailed.

Thanks Ricky! At first I thought that wasn’t a sexy topic but found it interesting, especially the part that a few days delay in paying isn’t notified to the credit bureau. We have about 30 to 40 credit cards so it’s impossible for me to remember to pay in time. So all my cards are set-up to autopay. Some people pay their balance every week, before the statement posts so no balance is reported to the credit bureau but this would be highly impractical for us when it’s time to split expenses (who paid this? who paid that? was that from the joint account? from my personal account??) as it adds an extra layer of complication to a situation that is already quite complicated.

I know my credit score would be better if I paid before the statement is issued but autopay is the compromise I found to stay sane and keep P2 happy.

Sometimes you gotta broach the un-sexy topics 🙂 Appreciate the input Mae!