As has been widely anticipated, American Express has taken steps to sweeten the deal on the Amex Platinum Card, now that their premium travel-oriented product has been rendered less meaningful because no one is travelling.

From today until July 20, 2020, Platinum cardholders will enjoy Double Rewards on both the earning and redeeming side. As American Express describes this campaign in their email:

Double Rewards: Double the points. Double the value.

Why Double Rewards? In these challenging times, some Platinum benefits may prove more valuable than ever before. But what about enhanced ‘everyday’ value?

One important Platinum benefit is Membership Rewards® points – where you earn points for virtually every $1 you spend. To ‘double down’ on this aspect of everyday Platinum value, we’re introducing Double Rewards: earn double the points, enjoy double the value – available from April 21 until July 20, 2020.

Earn Double the Points Through Double Rewards, over the next three months, you will earn double rewards points on all your spend: any retailer, anywhere and anytime*. Food delivery. Check. Online retailers. Check. Streaming services. Check.

Enjoy Double the Value Additionally, if you choose to pay (or partially pay) for any purchase charged to your Platinum Card with points – through the Use Points for Purchases program – you’ll enjoy twice the value.

Earn Double MR Points on All Platinum Card Purchases

Under ordinary circumstances, you earn MR points on the Platinum Card as follows:

-

3 MR points per dollar spent on dining

-

2 MR points per dollar spent on travel

-

1 MR point per dollar spent on all other purchases

Until July 20, these earning rates are double, thus looking as follows:

-

6 MR points per dollar spent on dining

-

4 MR points per dollar spent on travel

-

2 MR point per dollar spent on all other purchases

Needless to say, these are superb earning rates across the board. Doubled earning rates alone would be enough to drum up lots of excitement, but it gets even better when combined with…

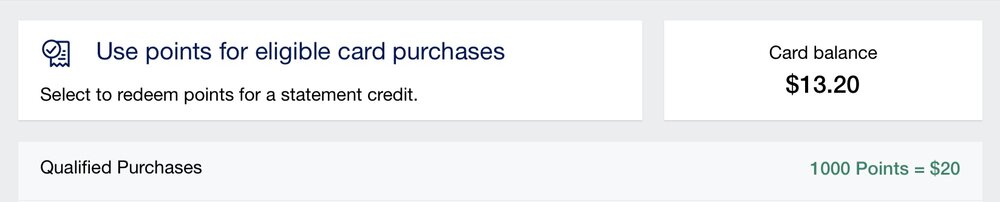

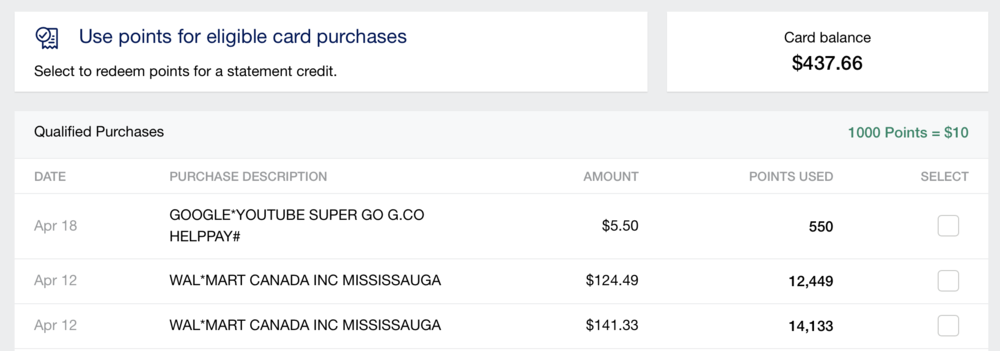

Redeem MR Points for Statement Credits at Double the Value

Previously, Platinum cardholders were limited to a rate of 1,000 MR points = $7 – equivalent to 0.7 cents per point (cpp) – when choosing Use Points for Purchases and redeeming MR points against general statement purchases, with only travel purchases being subject to the higher rate of 1cpp.

However, as another measure to appease cardholders when the card’s travel benefits have been laid low, American Express is now allowing cardholders to redeem MR points against statement credits at an elevated rate of 1,000 MR points = $20, which is equivalent to 2cpp!

This is a downright amazing development for cardholders at a time when many households and individuals might be prioritizing cash more than travel rewards, as it essentially allows you to “cash out” your MR points at a very competitive rate of 2cpp. Effectively, the Platinum Card has been temporarily reimagined as a 2% cashback card on the redemption side.

What’s more, when you combine the redemption rate with the elevated earning rates, you end up with a return on everyday spending that blows the competition out of the water

-

12% return on spending in the dining category

-

8% return on spending in the travel category

-

4% return on spending on everything else

Those are some jaw-dropping returns on your regular purchases, and easily makes the Amex Platinum Card the most compelling option for all your spending over the next three months.

Now, can there still be higher value to be gleaned from holding onto your points for future redemptions through programs like Aeroplan or British Airways Avios? For sure.

However, as I’ve shared previously, there’s a real case to put a greater emphasis on cash at the moment, whether it’s to deal with currently pressing financial needs or in response to a rapidly changing travel industry in which cash fares are likely to be lower for the foreseeable future, and you won’t find a more lucrative way to do so than what American Express has put on the table.

Are Food Delivery Services & Groceries Being Included Too?

While 12% and 8% earning rates sound amazing on the surface, the truth is that most of us will be spending relatively little amounts in the categories of dining and travel during the time horizon of this offer.

However, this morning a Prince of Travel Elites member, Victoria W, has reported that her Uber Eats purchases are now counting towards the 3x category on her Platinum Card, which was limited to dining purchases and excluded food delivery services in the past.

Neat little data point: I noticed that UberEats is now posting 3x points with my personal Amex Platinum I know food delivery was previously excluded from the card’s dining multiplier; I don’t have the Cobalt, so it’s a nice, if albeit temporary, change.

If this development rings true for all cardholders, then we’d see food delivery services earn at the 6x rate – and therefore cash out at the 12% rate – as well, which would be a significant discount for all the takeout orders that we’ve been putting in.

Alas, while I had originally imagined that grocery store purchases might join food delivery services in being bumped up to the 3x (and now 6x) category, the recent data points from Platinum cardholders indicate that this isn’t happening – groceries will remain at the usual 1x (and now 2x).

What About Other American Express Products?

For now, there’s no indication that similar measures have been implemented for the Business Platinum or other MR cards.

When choosing Use Points for Purchases on these cards, the rate remains at the 1cpp level when redeeming for statement purchases (although it’s worth mentioning that cards like the Cobalt Card, which previously allowed redemptions against general purchases at only 0.7cpp, have now been bumped up to 1cpp as well).

There’s always the chance that American Express announces similar relief for other cardholders at a later date, but I think it makes sense that most of the attention has been on the Platinum Card thus far. With a $699 annual fee, it’s by far Amex’s most premium and travel-centric card, and the fact that no one is travelling – and the full stack of travel benefits are therefore virtually meaningless – has resulted in the greatest uproar from Platinum cardholders compared to any other product.

I’d say that the Double Rewards campaign will go a long way towards appeasing Platinum cardholders, and may even entice new cardholders to sign up as well.

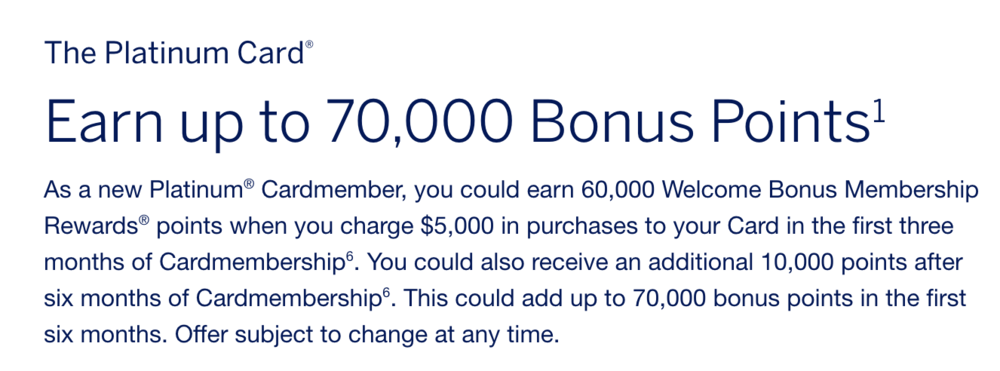

Indeed, the Platinum Card is currently offering a higher than usual signup bonus of 70,000 MR points upon spending $5,000 in the first three months and holding the card for six months (although you’d only get 60,000 points before July 20, when this promotion ends).

If we do the math, that $5,000 of spending – if you can manage it at this challenging juncture – will translate into at least 10,000 MR points given the elevated “6-4-2” earning structure, leaving you with 70,000 MR points in total before July 20.

Recall that the $200 annual travel credit can be used to reduce the net annual fee to $499, and if you didn’t want to be out-of-pocket any money at all, you could then redeem 24,995 MR points to cover the annual fee at the elevated redemption rate of 2cpp.

Adding back the 10,000 MR points that you’d earn after six months of holding the card, that would leave you with 55,005 MR points for a net $0 out-of-pocket!

None of us would’ve expected a rip-roaring signup bonus opportunity to emerge from this pandemic, but thanks to the Double Rewards promotion until July 20, that’s exactly what the American Express Platinum Card has thrown up.

Conclusion

In one fell swoop, American Express has addressed concerns among those who hold their top-of-the-line $699 Platinum Card and temporarily transformed it into the most powerful credit card in Canada by a huge margin.

The card’s power has been doubled on both the earning and redeeming side, resulting in a quadruple-strength card that should be the unrivalled top choice for all your spending – and should tempt many more new cardholders into applying – over the next three months.

Hi Rick, I just want to be sure I do it correctly, to get this offer I have to click on the referral link on this page? https://princeoftravel.com/american-express-platinum-card ?

Your podcast on Explore FI Canada was great. I’ll start to use my RBC Avion again.

Thanks a lot for everything

Just checked my points balances and noticed that Skip The Dishes purchases were only credited double points, not x6. Called the CS and they assured that Skip The Dishes are indeed part of the x6 promotions and will credit me the points within a week. So keep an eye on your accounts!

My Amex expires mid June. If I charged something on it, do I have to wait a full billing cycle (Ie for my statement) to apply my points as payment or can I do it immediately? I’d like to do this before renewal to cash out my points

If the membership fee counts against the minimum spend then you only have to spend $4301 to get your 60k bonus.

‘60,000 MR points upon meeting minimum spending’. By the way what is that website for amex cardholders to register for programs (like hotel rewards etc) URL pls…

The membership fee does not count again the minimum spend requirement.

Hi Ricky,

had been following you since you start your first youtube video, you make everything very easy to understand and easy to read.

I have few questions to ask you, currently my wife has one amex plat and I’m planning to refer to me for another amex plat.

Q1: Do you know when is the 1000 points : $20 credit rate promote will expire? Because I know referral deadline for 15,000 pts is May 12, 2020 and Double pts Promotion deadline is July 20, 2020 but I can’t find when will the 1000 points : $20 expiration date.

Q2: If I use plastiq to pay $5000 for the opening 60,000 pts + Spending 10,000 pts (10,000 pts is after 6 months of holding), when will I receive the total 70,000 pts? next billing cycle? If this way, I need to do another spending of $500 in order to spend 2,500 points for $500 to pay my bill right? (This way I will be able Cover my AF $699 – TC $200 = $499) right?

Thanks for your hardwork.

Kevin

Is there confirmation that the double rewards promotion is offered to all personal platinum cardholders? Because when I log into my account I can see the double earn rate but my redemption rate is still listed as 1000MR = $10 (and then in brackets that this is a limited time offer)

Thanks for the write up. I just applied using your link (please enjoy your referral bonus)

What do you think of buying AC gift card to get the 4x points?

Sounds like a good plan to me, as long as you envision yourself using them in the future.

Hi Ricky,

Given it sounds like groceries will be at 2x, would you put your grocery spending on the platinum or continue the cobalt at 5x select points? Thanks.

I’d still go for the Cobalt:

Cobalt effectively earns 2.5 Aeroplan miles per $ (via Bonvoy transfer)

I asked for the card on Wednesday. Arrived by FedEx yesterday (Friday). I immediately put $ 3,000 on the card with Plastiq. This morning, I had 6,000 points (2 * 3000) in my Amex account. I also have the possibility to apply my points on an at the rate of 1000 = $ 20 in my account. I therefore conclude that it also works for new card holders. My 50,000 points should be published in my account in the coming days.

Good stuff André, thanks for the data point.

Any news or reports of them waiving or reducing the $699 annual fee? I signed up in September.

Unfortunately, given the losses Amex looks set to incur in Q1 and Q2, I highly doubt we’ll see any annual fee waivers being offered.

What are your thoughts on the offer to Cobalt cardholders for 1CPP statement credits?

Value seems a bit low for anyone who was looking to use these points for travel originally, even for MR-S.

The change is pretty insignificant in my eyes, since you could always cash out at 1cpp using the refundable hotel trick before anyway.

2cpp on the Platinum, though, now we’re talking.

If my spend hadn’t decrease so significantly, now would be a great time to leap into a personal Platinum.

I still haven’t seen any reply or new info on questions posed by Mark and Fenand below. I clicked through on the referral link. The Amex website does not mention anything about this deal; not the 6/4/2 earning rate nor the 1000 points : $20 credit rate. One writer below mentioned that a call to the Amex 1800 number was fruitless as the CSR didn’t know anything about it. How can we avoid being burnt by Amex not living up to the details you have listed above, Ricky?

Front-line representatives have been known to be slow in catching up on breaking developments. It’s now been confirmed by Amex that the new earn & burn rates will apply to Platinum cardholders both old and new.

How easy is it to use the $200 travel credit? When there is no travel right now is my concern 😉

I received an email about a week ago stating if your travel credit Had expired or was expiring before Sept 30 (I can’t remember the exact date) it was automatically being replaced or extended another year.

Any idea if gift cards from travel sites are eligible as an AMEX Platinum "travel" redemption against statement credits at the elevated rate of 1,000 MR points = $20?

If so, does anyone have any suggestions on promotional travel gift cards that currently offer increased bonuses in purchasing gift cards?

For example, I see that Holland America Cruise Line has a promotion until the end of May that offers an extra $200 gift card when purchasing a $1000 gift card or more. If Holland America gift cards are an acceptable Amex Platinum travel redemption, then essentially a $1200 gift card for cruising can be had for a 50,000 MR point redemption or a $0.024 redemption, which is not too shabby.

The elevated rate of 1,000 MR points = $20 is now valid for all purchases, not just travel purchases – so your example would be valid.

Uber Eats was posting 3x before this promo IIRC (though not sure if Uber was posting 3x too as Cobalt was posting Uber as 5x). At least, my friend saw 3x for Uber Eats on her plat.

Here’s hoping I get 3x on groceries at Food Basics, will test soon. Glorious 6x for groceries, yes please!

Hey Ricky, I just called Amex Canada, too. The Rep said they will be getting a decision on whether Amex Canada will be extending the time to meet spending requirement (like the US) by the end of this week or early next. She also said the spending requirement is $3000 in the first 3 months for the first 50000 Bonus MR Points, which I double checked on the Amex website? You stated $5000 both in this blog and your Amex Platinum Card page? Did they just change that recently?

The public offer: 50,000 MR points upon spending $3,000 in the first three months.

When applying via a referral link: 60,000 MR points upon spending $5,000 in the first three months, followed by 10,000 MR points after six months of cardmembership.

You know I just called Amex….the person I spoke to didn’t know anything about the special offer for the Platinum card….I don’t understand how it is that she doesn’t know….makes me hesitate to jump into this card

I went to Amex Canada and see no evidence of this. How do i know this applies to new cards?

What i am referring to is the x2 for points

There are conflicting views of “do new applicants benefit from this”. Can anyone confirm before I take the plunge ?

This is now confirmed by Amex.

I can confirm that my food delivery orders through Skip the Dishes and UberEats have been are counting as dining (as has my Starbucks card reload).

If I apply for the Platinum and link my Gold card, can I redeem my Gold MR points at the bonus rate?

Yes I believe so.

I literally just cancelled my plat amex 2 days ago. Should I call and upgrade my gold card to platinum?

If I have 100k MR and want to take advantage of this offer, can I purchase something worth $2000 apply the MR than return the item thus leaving me with a negative balance on my card?

Am I missing something or is this the only way to use a statement credit with out having to make a purchase I don’t need atm.

Business Platinum too??

Not at this time.

Hey Ricky, any word on Amex Canada extending the time to meet spending requirements on the Platinum Card as is the situation with the US version?

No word on this yet.

oh I am just GLOWING ALL OVER!!

Glow up!!

I have not received the email confirming this from AMEX, but after logging into my account I see: 1000 points = $20!!

Awesome news! Thanks for sharing Ricky.

Two questions:

– Does anyone have any DP on other food delivery (Such as GoodFood) as well as grocery stores? I would love to hear that.

– If cash isn’t an imminent concern, would it make sense to rack the double points instead of taking advantage of redeeming them for statement credit? Arguably that’s still better value when redeeming for Business Class tickets. Thx!

Exactly what I am doing, racking up points for future use. I have been thinking about booking a flight with Air Canada since they allow you 24 month credit from the DATE of cancellation or change at no charge. I am really pumped with Amex doing this, they have turned me into a loyal customer for life.

Yes, you’ll still get greater value by booking business class through Aeroplan. But if you don’t have too many upcoming travel plans and are confident of earning more Aeroplan miles either, the 2cpp cash isn’t shabby either.

If I self refer from my Amex Gold, would that one move the points from Gold to Plat, and make it possible for me to redeem existing points (From gold) at 2x rate too?

Definitely don’t self-refer, as it’s explicitly against the new set of terms and conditions as of March 12. If you applied for a new Platinum card, though, yes you’d be able to link them and benefit from the 2cpp.

I am new to AX, can you please explain how you link the cards?

At this point if you self refer it’s probably a great way to make all your points and AMEX accounts dissapear real quickly… But you could apply for the Plat and then link your gold MR to the plat and redeem for double value that way.

Held / cancelled this card in March 2019.

Safe to try to re-apply and take advantage of this?

Or unlikely to be successful / get bonus points?

I would swear I recently read somewhere here, by a user who identified himself as "Amex Canada", that this card can’t be churned, or that we wouldn’t get a a repeat bonus. But would love to get DPs on this as well, as I’m the same boat (Had Amex Platinum in the past, and now only my P2 has it)

Would redeeming points for cash back count against the MSR? E.g. if I spend $5k then use the points against $1000 in purchases, do I need to put another $1000 on the card to keep the bonus?

I don’t believe it would count against the MSR. It would be a statement credit, not a refund.

Hi Ricky,

I didn’t receive the email but I do have a personal platinum. Will I get the bonus points?

I didn’t receive the email either but when I logged into my rewards account, I saw 1000 MR = $20. So, check your account, you might have it there.

I would think so. I’d be extremely surprised if this was targeted, as it would be grossly unfair to cardholders who weren’t targeted.

Hi Ricky,

Are there any indications that this promotion would apply to new sign-ups as well?

I signed up a month ago and did receive the AMEX email.

According to a data point from someone who called Amex to ask, yes.

Hi Ricky,

Sucks that Amex isn’t applying this to the Biz Plat.

For Business Platinum cardholders, getting a personal Platinum card and then merging the points would allow you to take advantage too.

So one could apply for this Platinum card and receive the bonus and then apply for the Business Platinum later on and still receive the bonus?